Earn interest on security deposits and rent collecting with Fung Deposits

Oct 12, 2023

Traditionally, property management platforms have maintained a singular focus: streamline property management tasks. Rent collection, lease signing, maintenance requests, and more have been brought online for the sake of efficiency. But what about financial innovation?

Money, especially in the form of rent and security deposits, often sits idle while waiting to be disbursed. Outside of countries where security deposits have to be safeguarded, this stagnation represents lost opportunities, especially when considering the potential of interest generation.

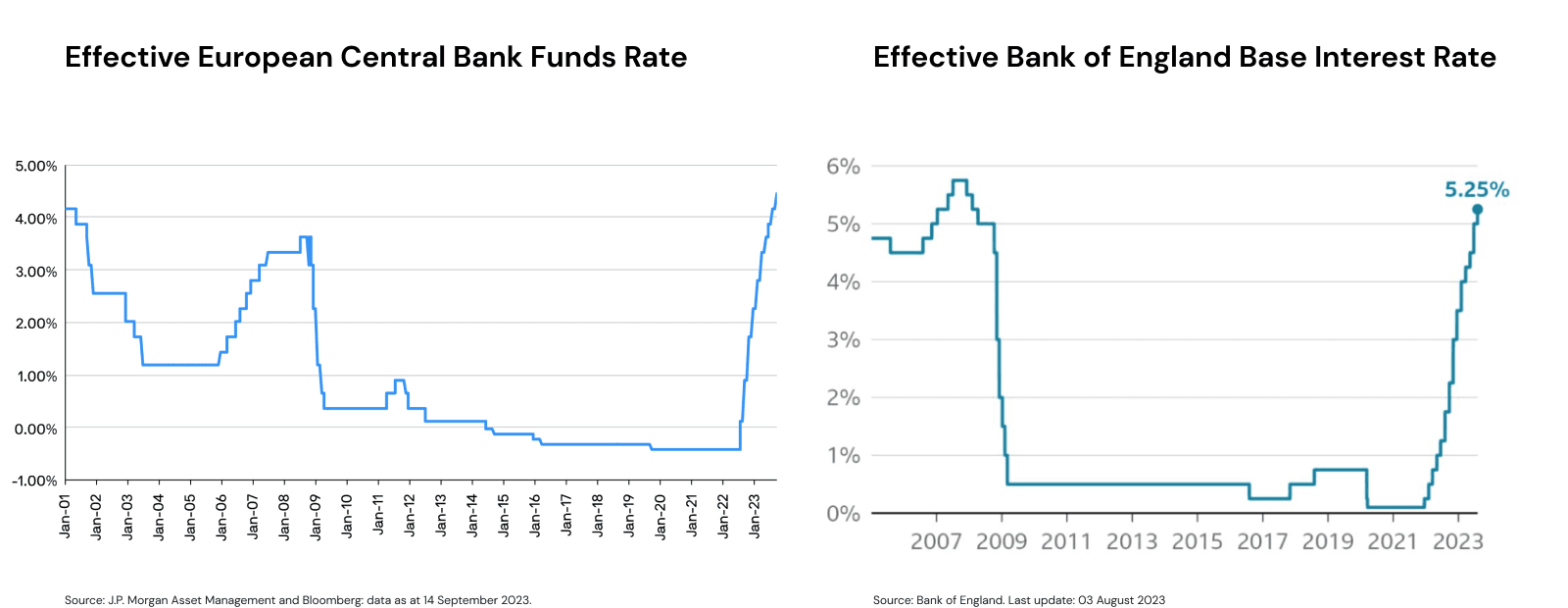

Earning interest on your customers’ deposits and rent volume is particularly compelling in light of the unique high-interest-rate environment we are in. Today, base rates are at 5.25% in the UK and 4% in Europe, and they’re expected to continue rising through at least 2024.

Our Solution: Fung Deposits

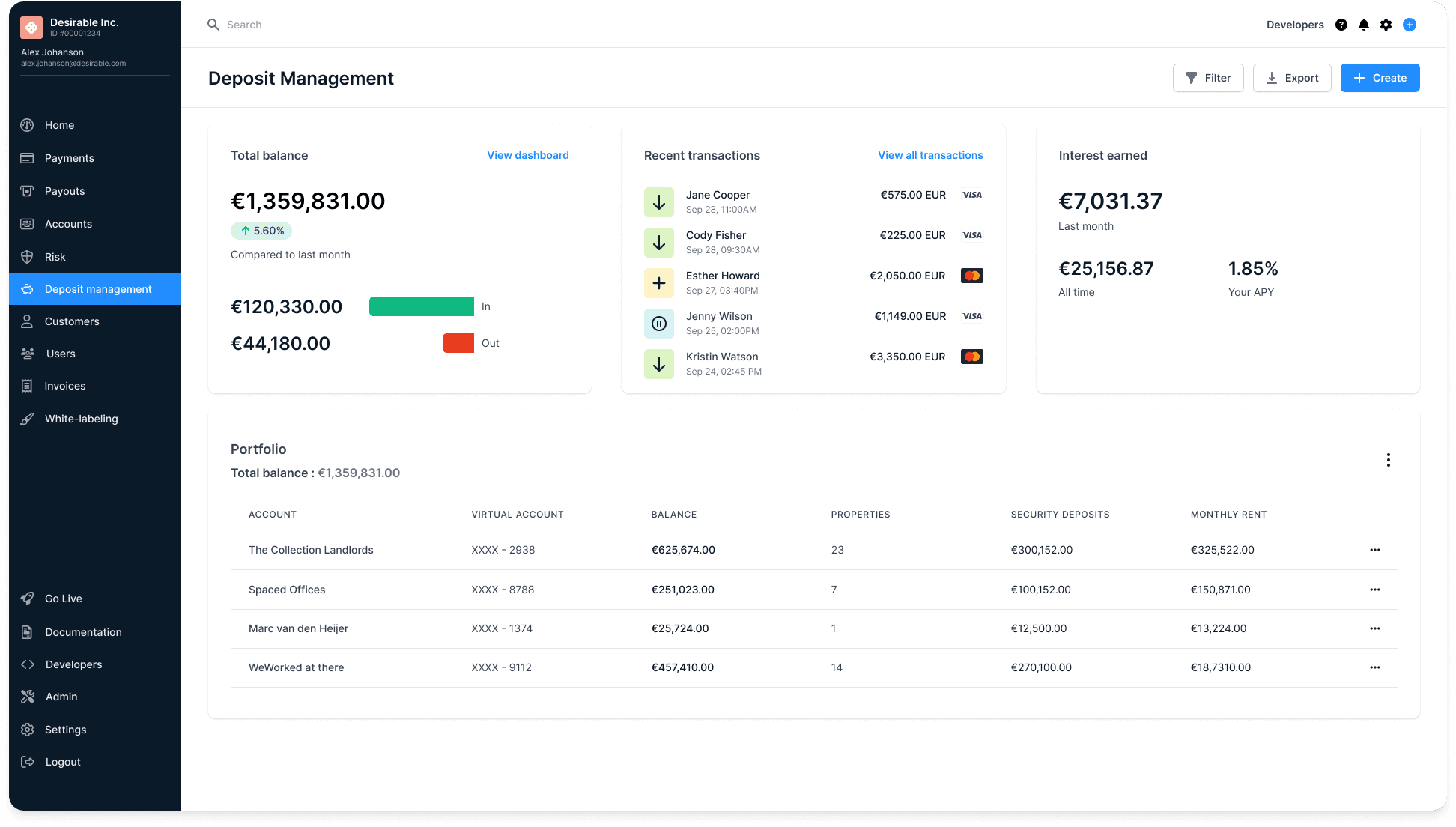

Our product provides a seamless and straightforward integration into your existing platform, unlocking the following benefits:

Embeddable Payments: With our integration, collect rent, deposits, and other payments directly through your platform, enhancing the user experience for both property managers and tenants.

Interest Generation: Instead of letting funds sit idle, we actively generate interest on those deposits and share a portion of the gains from the interest that goes directly to you—the platform—creating a win-win situation. This is done safely and securely, ensuring that your clients' funds are always accessible and never at risk.

How much could you be earning with Fung?

A Simple Scenario:

Imagine you oversee 10,000 units. Let’s assume the average rent for these units is €1,500, and a security deposit is usually equivalent to two month’s rent.

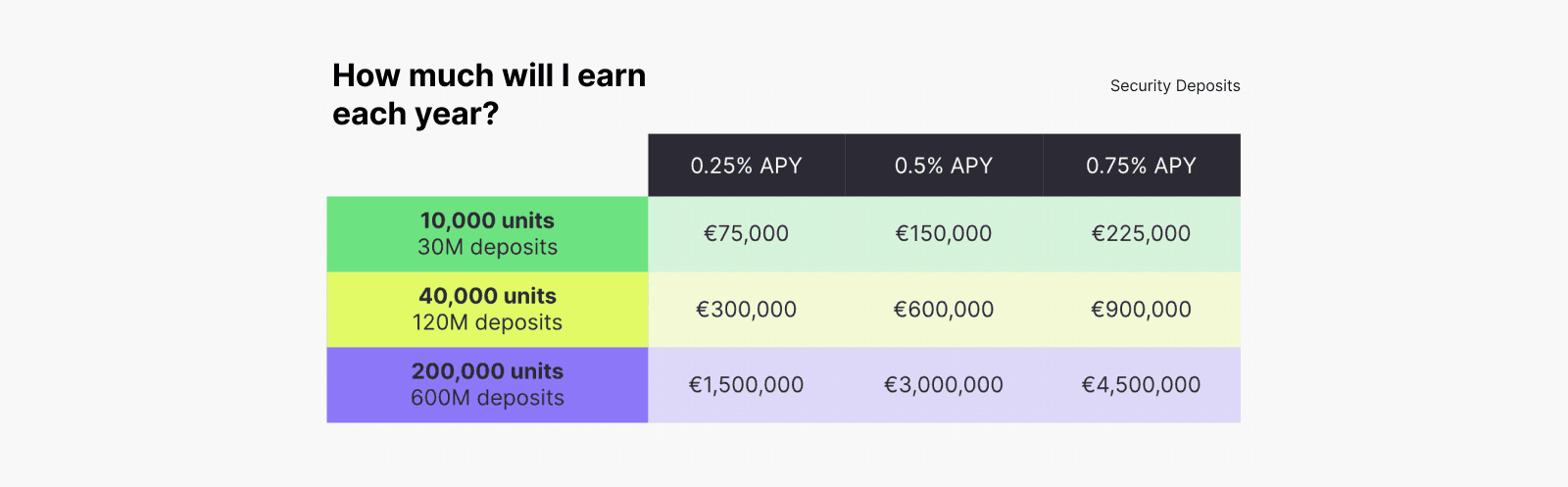

On Deposits

Total Security Deposits: 10,000 units x €1,500 x 2 = €30,000,000

For the sake of simplicity, let’s also assume that the balance in the account remains constant throughout the month (i.e., there are no lease breaks), and interests are paid out on a daily basis.

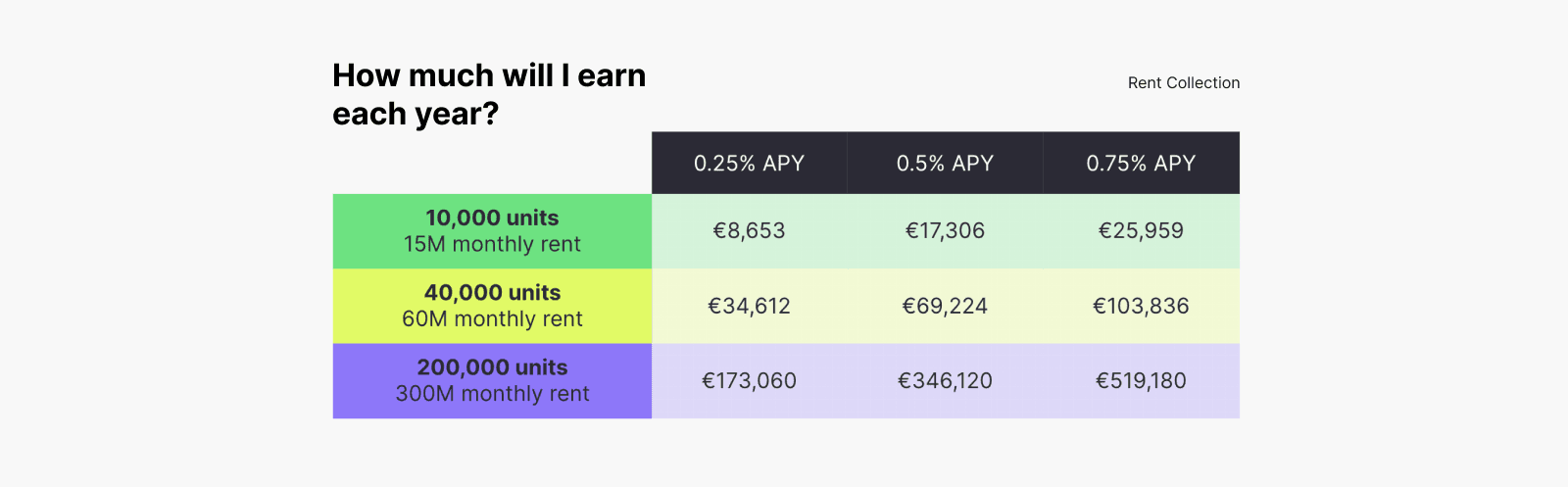

On Rent Collection

Using the assumption that while security deposits are held for the entirety of the month, rents are held for 7 days every month before being disbursed to landlords (as seen with other players).

There is an incentive to hold the funds collected from monthly rent for multiple days to generate daily interest that compounds. We have seen models like Azibo that disburse the funds by the 10th of the month.

Assuming the funds can yield an annual interest rate of 0.50%, that's an additional revenue of €167,306 every year, solely from the generated interest. And bear in mind these numbers are predicated on a portfolio of just 10,000 units.

As your platform grows, so does this revenue stream.

For platforms managing 40,000 units: potential interest revenues of €669,224 annually.

For those overseeing 200,000 units: a staggering €3,346,120 in extra revenue each year.

Beyond the Numbers

While the figures above provide a compelling glimpse into the financial benefits, it’s essential to understand the broader implications of embedding payments

Client Retention and Attraction: Offering a one-stop shop that includes rent collection services strengthens the relationships with existing landlords and property managers. They're not just using a platform; they're running their business on your platform and seeing a financial return.

Competitive Differentiation: In the competitive property management software market, having the most complete value proposition sets you apart from other local or European players, making it easier to capture market share.

Reinvestment Opportunities: The added revenue can be channelled back into platform development, marketing, or other growth-focused endeavours, further solidifying your position in the market.

Safeguarding Your Customers' Funds: Our Foremost Commitment

Working directly with the most trusted banks like ABN AMRO and LHV

We understand the paramount importance of financial security, especially when it comes to the customers’ funds you entrust us with. That's why we've taken exhaustive measures to ensure the utmost safety. We collaborate with established banking partners ABN AMRO and LHV to anchor our transactions. Their global renown underscores the security and trustworthiness we bring to the table.

We hold 100% of our customer funds separately from our own funds. This means all the funds we collect are held in a separate legal entity, similar to a foundation Stichting Custodian Fung Payments (”Stichting”). The Stichting is also being supervised by the Dutch Central Bank (DNB) as part of their supervision of Fung. In the unlikely event of Fung becoming insolvent, your funds are fully protected against creditors of Fung.

We operate as a Payment Institution under the supervision of the Dutch National Bank

Furthermore, our operations and procedures are under rigorous oversight and supervision of DNB, as we are a regulated Payment Institution. This means our practices, infrastructure, and controls are consistently monitored and held to the highest standards, ensuring your money is always secured.

To safeguard, Fung uses ABN/LHV only. The safeguarding accounts are designated specifically as “customers accounts”, meaning funds held therein would not form part of the estate of ABN/LHV in the unlikely event of their insolvency.